In a scenario where your company is contemplating upgrading your Enterprise Resource Planning (ERP) system. Don’t make the mistake of only implementing major changes to the basic operational processes and structures. Modern ERP is largely built around identifying the backend process that can be made more efficient or streamlined using automation. Regardless of this, many companies ignore the time-consuming tasks that impact accounts payable and invoice processing. Here is a deeper dive into why you should include automation in your ERP upgrade.

When you omit AP Automation from your ERP system, you are missing out on big opportunities to boost productivity, save money, and give your financial professionals more control over AP processes and workflows. Manual processes are time-consuming and exhausting, leading to decreased accuracy of information, and the lengthy process can lower productivity and morale.

- Paper-Centric Process

Managing your AP with your ERP can be a manual process that leaves a long, winding, wasteful paper trail. Invoices are faxed, mailed, emailed, and/or physically handed off to accountants in a multitude of different ways. Manual processing invoice data can mean putting yourself at risk for late payment penalties and upsetting your vendors. It is harder to reconcile and trace approval workflows and invoice-to-payment reporting when using a manual, paper-based process. Without an attributable approvals process, one that doesn’t allow an invoice to be processed for payment without designated authorizers indicating approval, you are at a greater risk of being a victim of fraud. - Limited Access Based on User Role

ERPs generally assign a role to each user that limits access to certain operations within the system. When users can only see snippets of the process, they lose sight of the larger picture; if an issue that occurs in one of the segments they don’t have access to, they’ll need to waste time pinpointing who has access and how they can finish the task at hand, which in turn interrupts that user’s workday. Beyond this potential for snowballing interruptions, your approvers may simply not have access at all; this case, which essentially equates to blind approvals, severely hinders the ability to accurately capture and track the progression of an invoice and ensure complete, precise, and timely payments. - Limited Visibility into Your GL Code

If you utilize a variety of payment methods, you will need to ensure that different accounts and areas of record are able to match directly with your true GL balance. You may have to sift through credit card statements, payment records, bank statements, etc. that have not cleared in the accounts yet, then manually reconcile everything in a spreadsheet. Even after you consolidate your balances in a spreadsheet, it still won’t include the payments that haven’t processed, checks that haven’t cleared, or that ACH payment you just scheduled for next week… This limited reporting makes it difficult to make confident financial decisions and impedes your ability to accurately report on cash flow. - Zero Mandate for Workflow Consistency

All of your invoices are received in different manners, through different mediums, in different formats. Your approval process may or may not trigger for a given invoice or it may be unclear whose approval is required before payment is permitted. This limits your ability to perform a smooth, accurate audit or develop a consolidated view of previous payments, approval history, and past invoices. You also may not have clear rules defined by your vendors that establish their preferred methods of payment.

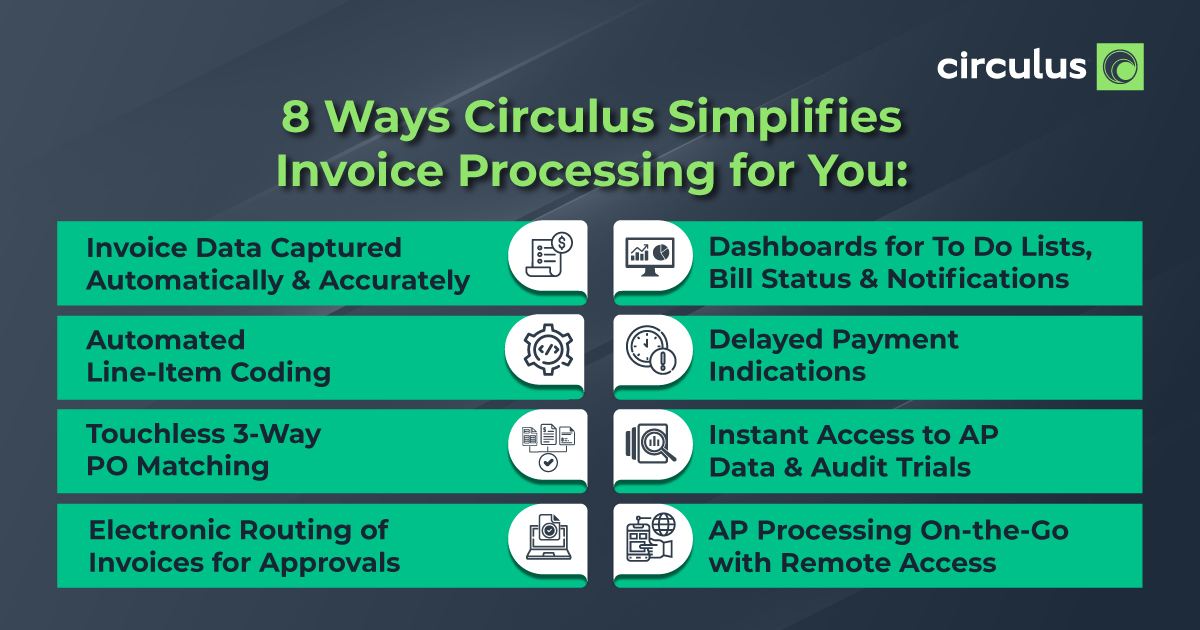

ERP alone is not enough for businesses to reap the high potential value of accounts payable; done right, AP Automation improves productivity across the company and creates actionable opportunities for savings and efficiency.