Now that you’ve determined that an accounts payable (AP) automation platform will benefit your company, it’s time to begin evaluating and choosing the right solution. When exploring AP automation solutions, the vendor options may feel endless. But, taking the time to research the right platform will ensure that the software addresses your unique needs, mitigates risk, and lives up to your expectations.

Digging deep into these two questions can help you begin the search process:

- What Does This Solution Offer?

First, your search for an AP automation solution most likely began due to workflow challenges your organization is hoping to resolve.

To understand how an AP automation solution will address these challenges, you’ll need to begin by pinpointing and defining the current problems and concerns within your AP department’s process. Once you’ve identified and mapped out the inefficiencies and what causes them, you’ll be able to bring the right questions to your potential vendor. You’ll want to share all the details and ask a vendor to walk you through how their solution can help solve process issues. If you send your workflow to a vendor ahead of time, they should be able to use this in their demonstration to showcase how their AP automation solution will help solve these specific problems.

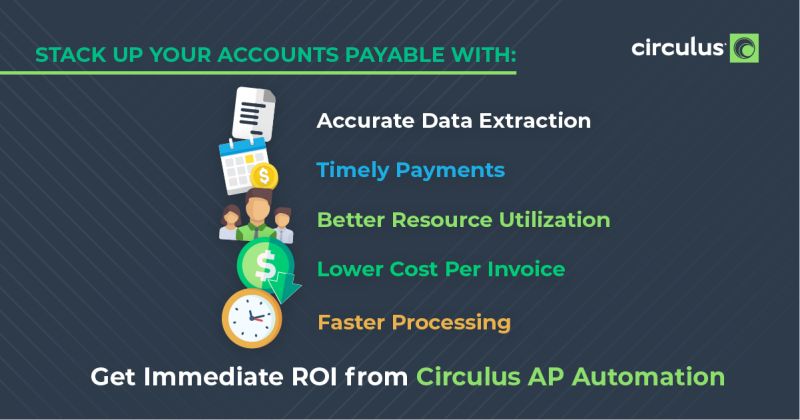

Double-check to be sure the vendor isn’t creating workarounds to fit your needs and pinpoint areas where you may need to consider adapting your team’s workflow to the new solution. Regardless, the right AP automation tool will improve your accounts payable processes from start to finish. AP teams should have visibility into the status of an invoice at every step, allowing companies to address bottlenecks, accelerate payments, reduce cost-per-invoice, and improve profitability.

Second, you’ll want to find out what parts of the invoice-to-pay process are included.

Not all AP automation solutions are created equal. There are various solutions in the market that range from simple document scanning and management to invoice workflow only to sole payment execution. So, you’ll want to get clear on what’s included in any potential platform and make sure it provides an end-to-end solution. All-inclusive platforms should include invoice capture, invoice routing and approval, data capture, purchase order matching, and payment execution.

- What Does The Platform Implementation, Training, and Support Look Like?

Consider The Software

First, it’s important to recognize there are two types of software used: on-premise and cloud-based. On-premise software is installed directly onto a user’s computer. These solutions require an IT department or a consultant to help maintain the system, often require a longer implementation period, and are difficult to keep updated.

Cloud-based solutions are accessed through the Internet, do not require any external support from an IT department, and can be implemented within a few days. Product updates and fixes can be installed easily and almost immediately throughout your entire organization.

Consider The Implementation Process

You’ll want to assess the implementation, onboarding, and training process. Find out who your point of contact will be once you begin using the system, how your team will get trained after implementation, and what kind of customer support you’ll receive throughout the life of the service when you have questions or issues. You’ll want to be sure you can reach your customer service contact easily without any extra fees or charges.

Consider How a Solution Integrates With Your Accounting Solution

Not all AP automation solutions will automatically synchronize with your accounting system, so be sure to ask if a vendor’s system includes API-level or file-based integrations that allow for two-way sync. Two-way synchronization ensures invoice and payment data flows back and forth between the accounting system and the solution.

Two-way integrations will also allow companies to leverage data from the ERP system regarding vendors, purchase orders, and receiving. An AP automation solution worth your time should integrate with your current accounting or ERP system. So, think twice about a solution that requires migration to a new central platform.

Don’t Forget!

There are many different AP automation vendors in the marketplace. Make sure you take the time to explore these multiple options so you can understand the differentiating features and determine the best fit for your organization. When you’ve found the right vendor, be sure to ask if they will help you build a business case for your management team. The answer should always be “Yes!”. Vendors should also be able and willing to provide a comprehensive demonstration of their software along with a trial or pilot period.

Just remember you have options! Your solution should provide a clear return on investment, help solve your workflow issues and grow with your business. So, don’t settle for a vendor that doesn’t meet your needs.