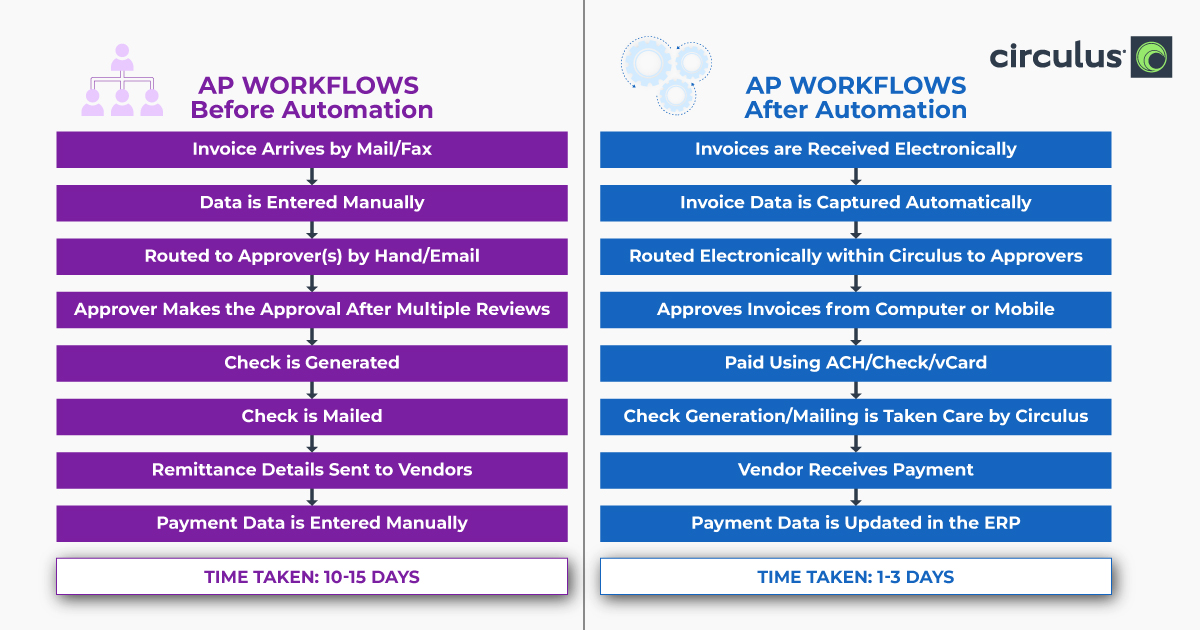

As organizations from a range of industries embrace digitization to increase efficiency and cut costs, most will explore the operational and financial benefits of using accounts payable automation software. When employees use manual methods to do their jobs, companies miss out on the many benefits of automation, such as significant reductions in time spent on manual data input, elimination of mistakes, increases in on-time payments, and the ability to cut invoice processing time through simplified routing and approval processes.

As companies decide to make the transition to AP automation software, they’ll find some common service features offered across software platforms, such as electronic funds transfers, tax form processing, and something called OCR.

What is OCR?

OCR technology is a key part of invoice capture, meaning the automatic extraction of invoice data. When an AP department receives an invoice, they must lift the information from that document and manually input that data into their system. For many accounts payable teams, this process is done manually; with OCR, the process becomes automated.

OCR stands for Optical Character Recognition and, in basic terms, is a technology that turns images into machine-encoded text. This enables automated conversion of a variety of scanned documents, electronic files such as PDFs, and digitally captured images into editable, searchable data.

For example, let’s say you receive a paper invoice; when you scan this document without OCR, you’re left with a non-editable electronic file. The only way to extract and input the data from that file is to read it and manually enter all the information into your accounting system. With OCR software, the information on the invoice is automatically pulled from the document and converted into an editable format. The best part is the whole data conversion process can take less than a minute.

Difficulties of OCR

While it is hugely beneficial to AP departments, OCR technology isn’t a magic bullet; it cannot work as a standalone tool and needs to integrate with dynamic accounts payable workflows.

Here are a couple of common issues surrounding OCR technology:

First, there are still data inaccuracies with OCR technology. While roughly 90% of your data will be accurately extracted, 10% of your data may still come through with mistakes; when you process hundreds of monthly invoices, it tends to add up. This means a systematic verification process is still required to find errors and double-check data fields.

Secondly, while OCR can recognize and read a wide variety of data, the methods and formats that businesses use to send invoices vary greatly. Invoice layouts and information are rarely standardized, and the format will likely differ from payee to payee. These varying invoice formats can make it difficult for OCR to read and extract data. It’s also easy to overlook invoices that include handwritten data, which are extremely difficult for OCR solutions to accurately capture.

Most importantly, while OCR can extract the data, it doesn’t intuitively know what the data means; the data must still be assigned meaning and then verified. If you work internationally or are planning to expand your business beyond domestic operations, you should also consider if your invoice recognition software can process data from a variety of languages.

In short, an Optical Character Recognition solution by itself is not necessarily a strategic investment.

OCR + Intelligence

Overall, OCR is a powerful tool that supports a successful AP workflow, but it has limited capabilities and must be partnered with a robust tech stack to maximize potential benefits. AP automation software takes the extracted data received from the OCR process and places this data into the correct fields for processing while also identifying and addressing inaccuracies with little or no manual oversight. For example, AP software should include an invoice scanning feature that can trigger and provide an alert when data is missing and route the invoice in question to a service team for review.

Using OCR combined with an added layer of artificial or human intelligence, many tasks that currently need manual intervention can be automated, such as:

- Transferring invoice information such as invoice numbers and amount totals into your automated AP system for payment processing with 100% accuracy

- Sending invoices to approvers automatically for sign off

- Matching general ledger codes to specific vendors or transactions

When your AP team has a “touchless” process, they can focus on value-add projects and more strategic work. Looking beyond the benefits of OCR, AP automation software also helps streamline your entire process by automating tasks such as invoice workflow, GL coding, document routing, and PO matching.

Transforming your AP workflow

Simplifying your AP workflow by automating your invoice collection, sorting, categorizing, and data input upon arrival can save tedious hours of invoice processing time. When sent electronically, invoices can be automatically processed quickly and free from errors using a combination of technologies; these processes are also highly configurable to fit your organization’s needs.

As your organization seeks to increase speed and efficiency by leveraging AP automation technology, it’s important to have a complete understanding of each solution you’re considering and how it can help you meet your business goals. While OCR is a key piece of AP automation, it is rarely the right solution on its own. Make sure you have a complete understanding of everything each solution offers.

While having invoice capture software is great, it’s also important to remember that opting for a cloud-based platform ensures that employees can access, review, and approve invoices within the AP system from anywhere, anytime. Companies should also consider how the platform will be able to grow with your company as you add more payees and vendors.

The benefits of digitizing invoices and capturing their data are clear: teams can streamline approval workflows, cut invoice processing time, eliminate mistakes, ensure on-time payment, improve working capital management, and optimize performance, all while driving rapid ROI. Automation empowers companies to create personalized workflows that enable stronger, nimbler, and more efficient accounting teams.