Finance departments are the engine of a company’s business and CFOs are the hub of that system. Today’s CFO is charged with helping companies grow, exploring, and supporting the implementation of new business models. Keeping a pulse on laws and regulatory changes, supporting key security measures, and running crucial day-to-day finance operations also fall under the CFO’s responsibilities.

To ensure finance departments are working at optimal levels, CFOs are also charged with the task of creating a modern work environment that enables them to stay on top of technology trends, and drive software implementation that improves team, department, and company’s efficiency and productivity.

To accomplish this, they must become a leader of digital transformation within their company by building a technology stack that provides a core foundation upon which everything else can stand. This means choosing the right software, software to process invoices, pay bills, manage payroll, store, track, and analyze data, build reports, and detect fraud. On top of that, it’s important to have the right enterprise resource planning (ERP) management software in place to ensure all these software platforms integrate and work with each other.

So, where do you begin?

To be clear, when we talk about a finance “tech stack” we are simply referring to the combination of software CFOs use to do their jobs. There are many ways to build a tech stack and choosing the right technology provides opportunities for CFOs to streamline budgeting, reporting, accounts payable, payroll, reconciliation, etc.

Some key questions for CFOs to consider when building a tech stack are:

- Do you have a clear understanding of your company’s spend culture?

- How is your current tech stack built? What are the strengths and weaknesses?

- What company issues should your tech stack help resolve? (i.e. project over expenditures, communication, monitoring and reporting, quick access to data, etc.)

- Do you have a clear understanding of current industry standards and trends?

- Does your tech stack help your team achieve company objectives?

- Does the tech stack provide you with the level of analytics and scenario planning needed to help the company grow and change?

- Will this help your team become more effective?

- What roadblocks are standing in the way of implementation? (i.e. is the staff willing to learn and adapt to a new software system?)

- Are all the right people involved in decision making and vendor meetings, such as your IT department?

Though tech stacks can be built in a variety of ways, they should all be efficient, integrate well together, ensure you can always retain your company’s data, and be able to grow alongside you in the future.

Here are some other financial software decisions to consider as you make tech stack choices:

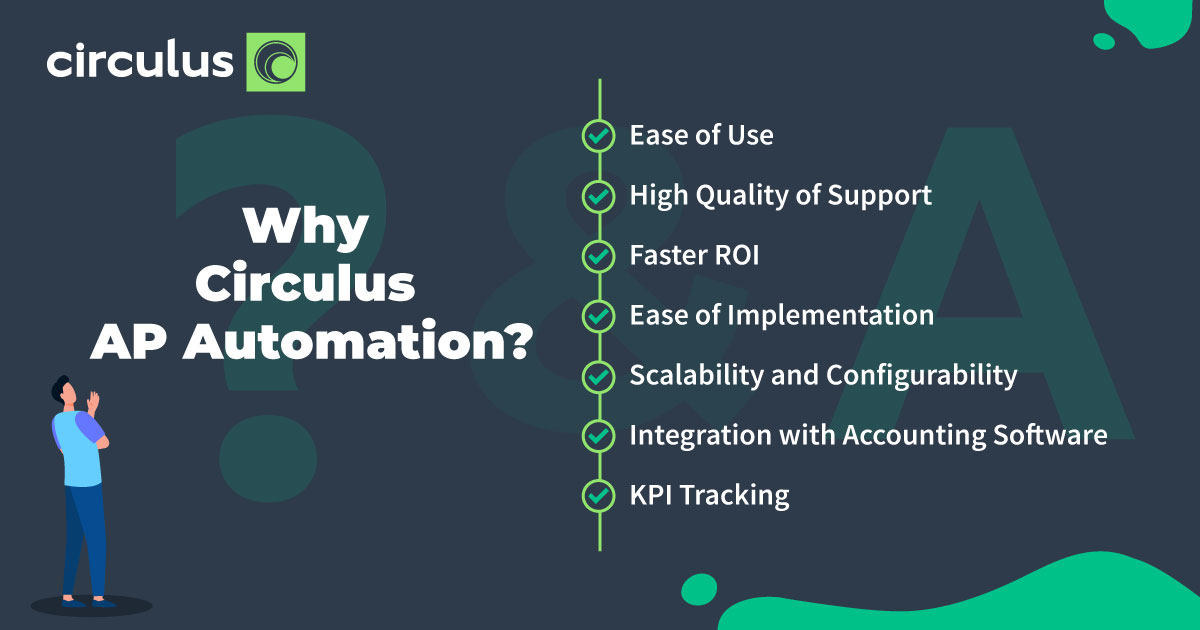

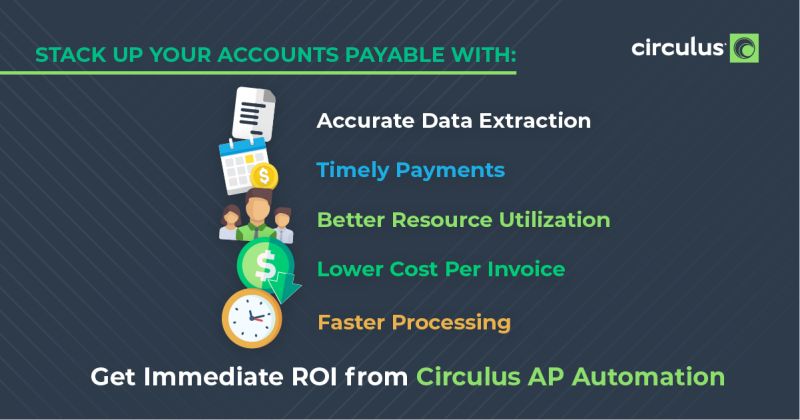

Accounts Payable Software

Accounts payable (AP) software can help your AP team’s process management, automate repetitive financial tasks such as accounts payable, expense reports, profit and loss statement generation, and data entry.

AP automation software dramatically increases productivity, helping staff to handle an increasing volume of payables in half the time. Invoices are processed faster, manual data entry and coding errors are reduced, there are no lost or misplaced invoices, approval cycle times are minimized, and payables are routed automatically and instantaneously. You’ll be alerted to duplicates and reminded of pending due dates and never mistakenly overpay an invoice, pay an invoice twice, or be in danger of making late payments. And accounts payable fraud detection is easier with an automated engine.

Payment Processing + Billing

Collecting and accounting for client payments is a core financial function. Payment processing software should be able to accept payments in-person and online by credit card, check, bank transfers, and other methods. Accepting payments online ensures your organization gets paid faster. You can even use payment processing to set up subscriptions or recurring payments.

Billing software is designed to help the accounting team invoice clients, accept payments, and send receipts. Billing software should be able to grow with your company and automate payment processing, freeing up your team to focus on more strategic tasks.

One important thing to note: ideally your accounting software should integrate with both payment processing and billing to automatically track and reconcile transactions.

Payroll Software

There are many options for payroll and HR software that go above and beyond the functionality of accounting programs by adding additional tools to manage taxes and withholdings, employee benefits, new hires, terminations as well as track employee time and attendance. Automated payroll software is cloud-based, so multiple team members can view payroll reports at the same time and eliminates the need for spreadsheets. Using an automated payroll system also ensures that employees get paid on time.

Customer Relationship Management

Customer relationship management software (CRM) can be used to track and correspond with your customer base. This software helps businesses build strong relationships with their clients and improve revenue rates based on the customer data coming in from multiple channels (i.e. phone calls, websites, social media etc.) Companies can use their CRM system to process and analyze customer information, create sales funnels, and carry out loyalty campaigns. Again, CRM software should integrate with your ERP system and, ideally, you’ll want to find programs that are very user-friendly.

Reliable Data + Reporting

Reliable, accurate, and current data is one of the CFO’s most valuable assets. Strong data helps with forecasting (looking to the future and using data sets to predict an organization’s financial outcome) as well as budgeting.

Many businesses still conduct reporting using manual data entry and spreadsheets that come attached with time-consuming, inconsistent, intensive efforts fraught with errors. Fully automated data capture and sophisticated analytics allow you to forecast a truer picture of costs and better control P&L giving you more confidence in your financial predictions and reporting.

Having the right technology ensures employees have access to the data they need from across the organization. When everyone works from a single source of truth, CFOs and their teams can deliver accurate reports more frequently, complete a financial close quickly, and dive deeper into company data to deliver strategic insights to other leaders within the organization.

Don’t Forget Security

Large or small, a company is always at risk of a security breach whether the hackers’ goal is to steal money or confidential data. Despite what you may think, a digital approach offers a much higher level of security for you and your customers’ data than paper. When data is stored and updated centrally, CFOs can control and monitor access, so staff only touch the data that is relevant to them. In addition, numerous safeguards, encryption, and banking-level security measures work together to protect your documents and keep your company safe from phishing scams.

Automation also makes compliance simple and minimizes audit risk. Secure, permission-based access with audit trails makes complying with accounting and industry regulations easier.

The Benefit: Get Ready to Grow

Ensuring the right IT infrastructure, building a team of people with the right mindset and skillsets, capturing the right data, and getting the right processes in place are decisions every CFO must consider when driving change and implementing technology. Though it might feel overwhelming at first, it’s a fact that investing in payroll, accounting, billing, and payment processing software is a proven method for scalable growth. Most importantly, we must remember that change is not a “one and done” thing. CFOs and their organizations must adapt and create an environment and culture that embraces continuous change.