The role of today’s CFO is changing. While continuing to serve as the financial face of their organization, CFOs are evolving to become digital transformation leaders within their companies, leaders that can bring an international perspective, a strong understanding of operations, and the ability to drive value through the use of data and analytics.

While those in this position continue to face issues related to growth, capital, crisis, infrastructure, transitions, and relationships, the role is broadening to include forward-looking strategies that guide the organization through a rapidly changing business world.

According to Korn Ferry’s 2018 CFO Pulse Survey, there are three main factors that keep CFOs awake at night: recruiting and maintaining top talent, lack of organizational alignment, and the threat of cybersecurity breach. Today’s CFOs are beginning to recognize how accounts payable (AP) automation can address these issues.

AP automation is proving to be an ideal solution for CFOs looking to create a nimble, collaborative environment that operates with efficient, cost-effective workflows and increased transparency. And as more people choose to work remotely, cloud-based AP automation makes your database of payment and vendor information accessible from anywhere, at any time.

Overall, CFOs and their teams can work at peak performance by enhancing processes and staff efficiency, providing reliable reporting, and reducing risk; here’s how:

Creating Tech-Savvy, Efficient Workplaces

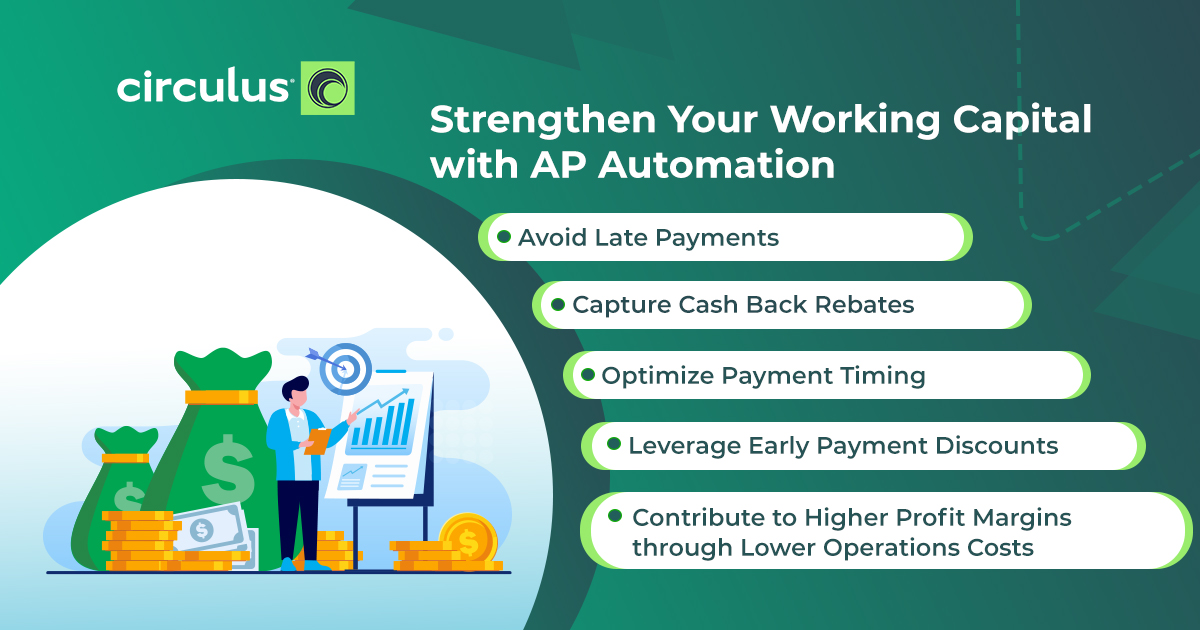

CFOs hoping to attract young, tech-savvy millennials can start by creating a modern, efficient workplace. AP automation empowers companies to design personalized workflows that create stronger, agile, and dynamic accounting departments. Teams can streamline approval workflows, cut invoice processing time, eliminate mistakes, ensure on-time payment, improve working capital management, and optimize performance, all while delivering a strong return on investment.

Here’s a glimpse into how it works:

AP departments can house their invoices and invoice data on one centralized platform. Using configurable workflows, invoices are sorted, categorized, and validated upon arrival, and digital or handwritten data is automatically captured, error-free. The invoice is then automatically routed to the appropriate approver, along with notifications that ensure the invoice doesn’t get missed.

AP automation platforms store all necessary and supporting documents while capturing and digitizing data such as GL codes, line item information, and terms. Invoices are automatically compared to corresponding POs and mismatches are flagged.

AP automation makes electronic payments simpler by providing one central location from which to choose your payment method of choice. You can digitize supplier information and organize vendor data as well as schedule approved payments to be sent out on or before their deadline. This eases supplier onboarding processes, simplifies vendor selection, and improves relationships.

The best part? Everyone can access up-to-date, real-time, accurate invoice, and vendor information, anywhere in the world, at any time, so that they can work together seamlessly from any location.

Overall, digital processing reduces the number of tedious manpower hours previously spent on processing invoices. This means staff members once embroiled in manual paper-based processes can take on strategic projects and analytical work that supports organizational efficiency and growth.

Using Data to Drive Strategy

Data and analytics, along with strategic thinking, currently rank as the highest priorities for most CFOs. Companies are using business intelligence data to optimize operations, evaluate risk, and analyze customer behavior to drive strategy. Korn Ferry’s Survey reports that 84% of CFOs are leveraging data through technology tools such as AP automation.

The data captured through AP automation can help CFOs with some of the most important parts of their job, such as strategic planning, target setting, financial planning, forecasting, and advising on critical company decisions. Organizational data is centralized in a single platform that provides a comprehensive, searchable database of payment information and financial history.

Here, CFOs can gain insight into data that supports portfolio analysis, performance analysis, and investment analysis, positioning them as principal advisors on executing strategy, supporting mergers and acquisition support, and engaging the board of directors.

Fully automated data capture and sophisticated analytics allow you to forecast a truer picture of costs and better control P&L, giving you more confidence in your financial predictions and reporting. CFOs can analyze department performance and examine historical data quickly in order to strategize innovative ways to save money and meet budget objectives. Cloud-based AP solutions also simplify mandatory reporting and data gathering for regulatory compliance and the creation of enterprise ESG reports.

Access to data provides the transparency needed to correct mistakes, minimize losses, and maximize resources. Companies that make a shift to AP automation don’t just improve their departmental processes but unlock the potential to turn their AP team into a digital, data-driven, and strategic powerhouse.

Risk Mitigation in a Cyber World

Believe it or not, automation actually provides greater security than manual, paper-based processes. Sensitive files on paper can easily be compromised and the paperwork can be misfiled, destroyed, or stolen. A digital approach offers a much higher level of security for you and your company’s data.

When data is digitally stored and updated centrally, CFOs can control and monitor access so staff only touches the data that is relevant to them. In addition, numerous safeguards, encryption layers, and banking-level security measures work together to protect your documents and keep your company safe from phishing scams.

Automation makes complying with regulations simple and minimizes audit risk. Secure, permission-based access with audit trails make complying with accounting and industry regulations easier. You can track invoice history and approvals, assure a chain of custody, apply controls for PCI, HIPPA, and other rules and regulations, and prevent documents from being destroyed or discarded ahead of deadlines.

The Future is Now

AP automation empowers CFOs and accounting departments to take a confident step towards using their resources in more efficient ways, leading to greater savings and growth. Teams that implement data, insights, and opportunities uncovered by AP automation can expect the direct, positive benefits of time and money saved along with reduced busywork and a workplace culture that is transparent, collaborative, efficient, and forward-thinking. Automation empowers organizations to create a future where accounts payable is no longer a tactical, back-office function but a strategic and visionary part of the company.