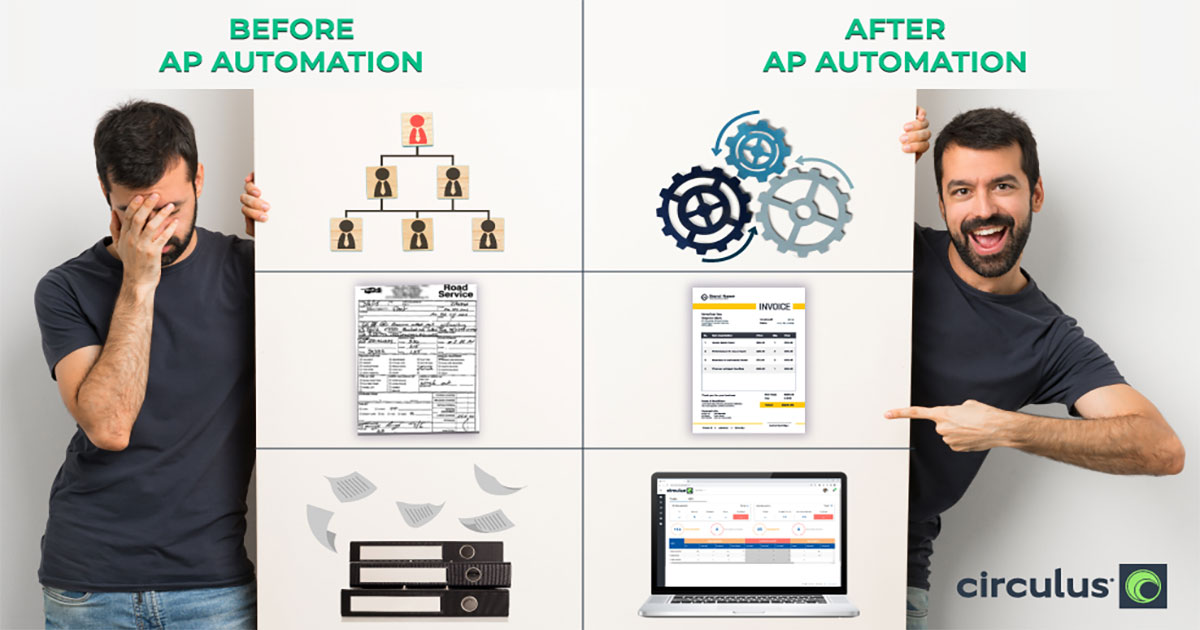

Accounts payable is a fundamental part of any business. You can bet that any company in any industry has an AP function at the core of its financial operations. While many other business processes have transitioned from manual workflows to digital workflows, Accounts Payable processes haven’t always kept pace and continue to be costly, manual, and people-intensive.

Here are four actionable reasons why you should digitize your AP operations:

- Reduce Invoice Processing & Payment Time

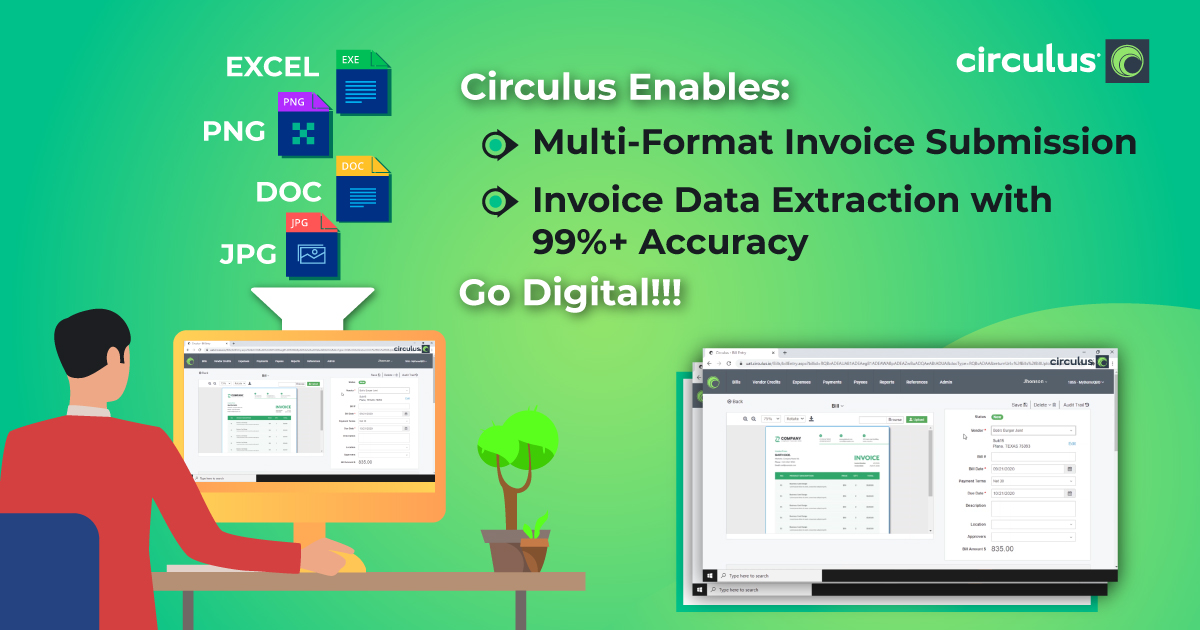

Automating AP processes helps to speed the pace of business by capturing data and routing validated data directly to business systems. The documents are tagged, and verified data is extracted directly to your ERP system without manual keying or entry. This reduces the time your staff spends on menial tasks and streamlines the process. -By dealing with an invoice just once, you automate the review and approval process, which saves time, increases data accuracy, and makes sure the workflow is efficiently handled. - Capture Early Payment Discounts

Through AP Automation, you can take advantage of early-pay discount incentives that you might be currently missing. Since invoices are processed faster, and the data is stored and accessed directly in your ERP system, all of your professionals will have all the records and info they need to pay promptly, enabling them to capture early payment discounts. These savings, along with the reduction of late payment penalties, are prime reasons to digitize your AP operations. - Boost Vendor Relationships

Just like a satisfied customer is a repeat customer, it is also true for vendors who help to keep your business in check. If you manage accounts efficiently and pay faster and with higher accuracy, you will be able to establish stronger relationships and inspire loyalty with your vendors and suppliers. Since information flows more freely between agents and departments, vendor inquiries are answered faster and in a more precise fashion. This results in issues being resolved long before they become much larger problems, which in turn further streamlines the entire procure-to-pay process. - Improve Insight

The benefits of greater visibility into the AP process and increased data accuracy allow you to precisely predict financial outcomes and make confident business decisions. Since all of this relevant content can be easily located, accessed, and utilized, financial managers have a more robust and immediate view of data to reliably run predictive analytics reliably.

Because of this, CFOs have a clearer picture of where they stand from a spend perspective, and AP professionals can better eliminate invoice processing bottlenecks, allowing them to focus on the accounts that require attention.

As you consider new ways to approach accounts payable processes, consider all that digital transformation can offer. Look for providers and partners that offer the right type of expertise, capability, and vision that will increase value as you digitize your AP operations.